Open Hassle-Free Payroll Solutions-- Contact CFO Account & Services for Payroll Services

Optimizing Effectiveness and Precision With Comprehensive Pay-roll Providers for Local Business

With the complexities of tax laws, worker benefits, and payroll calculations, the demand for detailed payroll services comes to be progressively apparent. As tiny companies make every effort to navigate the intricate landscape of payroll monitoring, a tactical partnership with dependable pay-roll solutions can confirm to be the cornerstone in accomplishing operational quality and monetary stability.

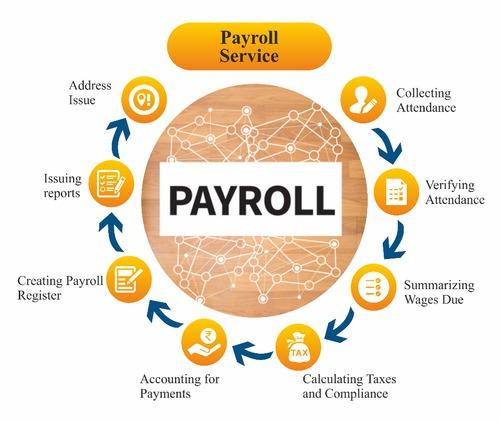

Relevance of Comprehensive Payroll Solutions

Ensuring prompt and precise pay-roll processing is crucial for the monetary security and compliance of small companies. Comprehensive pay-roll solutions play a crucial role in handling staff member settlement, taxes, benefits, and reductions successfully. By contracting out payroll tasks to a specialized service provider, small companies can streamline their procedures, reduce mistakes, and stay up-to-date with ever-changing tax obligation regulations.

One trick benefit of extensive payroll services is the elimination of hands-on mistakes that can take place when processing payroll in-house. Pay-roll service providers use advanced software to automate computations and produce accurate paychecks, lessening the risk of blunders that can bring about costly fines or annoyed workers. Furthermore, these services aid little companies remain compliant with regional, state, and government tax regulations by taking care of tax obligation withholdings, filings, and reporting needs.

Improving Payroll Procedures

Additionally, setting up direct deposit options for workers can additionally streamline the payment procedure, eliminating the requirement for physical checks and lowering management overhead. Frequently maximizing and reviewing payroll operations can aid determine bottlenecks or inefficiencies, allowing businesses to make needed adjustments for smoother operations.

Additionally, outsourcing pay-roll services to professional companies can use little companies accessibility to proficiency and sources that can dramatically enhance pay-roll procedures. These providers can handle intricate pay-roll jobs successfully, liberating valuable time for local business owner to concentrate on core operations and development methods. Ultimately, enhancing pay-roll procedures brings about raised precision, compliance, and general performance within little companies.

Making Certain Compliance and Precision

For small services, keeping conformity and precision in pay-roll processes is paramount for monetary security and lawful adherence. By making use of extensive pay-roll solutions customized to little organizations, proprietors can navigate these intricacies with confidence.

Professional pay-roll solutions offer small companies with the expertise needed to remain compliant with federal, state, and local guidelines. From determining deductions and taxes to preparing precise payroll records, these services supply a reputable service to ensure accuracy in every action of the pay-roll process. In addition, staying compliant with regulations such as the Fair Labor Specification Act (FLSA) and the Affordable Care Act (ACA) is important for avoiding penalties and keeping a favorable online reputation.

Cost-Effective Pay-roll Solutions

To optimize monetary performance, small companies can discover cost-efficient pay-roll solutions that streamline processes and decrease expenses. One approach is to buy payroll software application customized to the details requirements of small more information companies. These software application services often offer functions such as automated tax obligation calculations, straight down payment capabilities, and adjustable reporting functionalities, decreasing the moment and effort required for pay-roll processing. In addition, outsourcing payroll to a reliable third-party solution provider can be a cost-effective option. By outsourcing payroll, tiny companies can take advantage of the knowledge of experts that can make certain compliance with tax policies and take care of all payroll-related tasks effectively. This approach can assist organizations save cash on hiring and training internal pay-roll personnel, along with preventing prospective expensive mistakes. Ultimately, by executing these economical payroll options, small companies can assign their resources more successfully, emphasis on core organization tasks, and accomplish greater monetary stability - Contact CFO Account & Services for payroll services.

Leveraging Technology for Performance

Using innovative technological tools can substantially boost functional efficiency in handling payroll processes for little services. Automation plays an essential function in streamlining different pay-roll tasks, such as computing employee reductions, tax obligations, and earnings. Payroll software program can automate time tracking, generate digital pay stubs, and assist in direct down payments, saving and minimizing manual errors time. Additionally, cloud-based pay-roll systems use small companies the adaptability to access payroll information anytime, anywhere, and make certain data security through security and secure web servers.

Moreover, integrating pay-roll software application with other HR and accounting systems can produce a smooth circulation of info, removing the requirement for hand-operated information access and minimizing the risk of inconsistencies. Advanced functions like automatic tax obligation calculations, compliance updates, and record generation additional simplify pay-roll administration for small companies. Welcoming mobile applications permits staff members to access their payroll info conveniently, enhancing transparency and interaction within the organization. By leveraging click here to read innovation efficiently, local business can maximize their payroll procedures, minimize expenses, and boost general performance.

Conclusion

To conclude, thorough pay-roll solutions play a vital duty in making best use of effectiveness and precision for small companies (Contact CFO Account & Services for payroll services). By improving processes, guaranteeing compliance, and leveraging innovation, organizations can save time and resources while lessening mistakes. Cost-effective options even more boost the advantages of outsourcing pay-roll solutions. In general, the importance of detailed payroll services can not be overstated in aiding local business operate efficiently and efficiently.

As little services aim to browse the complex landscape of pay-roll administration, a critical partnership with reputable pay-roll services look at here now can confirm to be the linchpin in achieving operational excellence and monetary stability.